The Rise of Technology Company Insolvencies in Australia and the Role of Software Escrow

Australia has experienced a sharp increase in corporate insolvencies over the past year, with technology companies among those heavily impacted. This trend underscores the growing need for proactive measures like software escrow to protect businesses from the risks associated with vendor insolvency. Below, we explore the latest insolvency statistics, their implications for the tech sector, and how software escrow can provide critical support in these challenging times.

Current State of Corporate Insolvencies in Australia

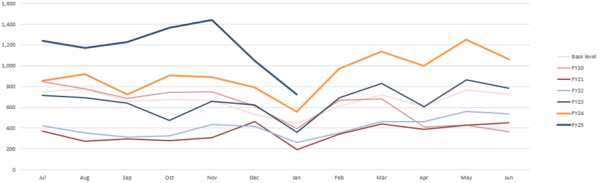

The latest data from the Australian Securities and Investments Commission (ASIC) reports a significant rise in corporate insolvencies during the 2024-2025 financial year compared to the record-high 2023-2024. Over 11,000 companies entered external administration or had a controller appointed in 2023-2024, marking a 39% increase from the previous year and the busiest period for insolvency practitioners since 2012-2013.

In the first seven months of 2024-2025 alone, more than 8,500 companies faced the same fate, projecting a total exceeding 14,000 by year’s end. The technology sector (Information, Media, and Telecommunications) saw a striking rise in insolvencies, with a 33% increase from February 2023 to February 2024, followed by a further 23% increase from February 2024 to February 2025

Key Statistics

- Total Insolvencies: 11,049 companies entered external administration during FY2023–24. 14,000 companies projected to enter external administration during the current financial year.

- State Breakdown:

- New South Wales (NSW) led with 4,634 insolvencies.

- Victoria (VIC) followed with 2,862 cases.

- Queensland (QLD) recorded 2,036 insolvencies.

Construction and hospitality dominate insolvency statistics, technology companies have also faced significant challenges. Rising interest rates, difficulty in raising funding, inflationary pressures, and lingering effects of the COVID-19 pandemic have created an environment where many businesses struggle to remain solvent.

Impact on Technology Companies

The technology sector has not been immune to these financial pressures. Several high-profile Australian tech companies have entered administration recently:

- Euclideon: A 3D data visualization company went into administration in February 2024.

- Plutora Australia: Backed by a Macquarie Bank, this tech company entered administration in April 2024 with debts totalling $37.3 million.

- Redback Technologies: An inverter and battery company entered voluntary administration in March 2024 but resumed operations under new ownership after restructuring.

- Emerson Media: Melbourne based media-tech company collapsed with debts of more than $12 million in August 2014.

These examples highlight the vulnerability of tech firms to financial instability. For businesses relying on third-party software solutions provided by these vendors, insolvency can disrupt operations and result in substantial losses.

The Role of Software Escrow in Mitigating Risks in Australia

Software escrow is a proactive solution designed to safeguard businesses against disruptions caused by vendor insolvency. It involves placing critical software source code and other assets into a secure escrow account managed by an independent third party. In the event of vendor failure or insolvency, the escrow agreement allows customers to access the source code to maintain business continuity.

Escrow London, a recognised leader in providing software escrow in Australia, has observed a significant increase in software vendor insolvencies over the past 18 months. The company now manages 1 to 2 trigger events per month, compared to 1 to 2 trigger events annually before the recent shift in economic conditions.

Benefits of Software Escrow

- Business Continuity: Ensures uninterrupted access to essential software code, databases, deployment scripts and access credentials even if the vendor ceases operations.

- Risk Mitigation: Protects against potential loss of intellectual property or operational capabilities due to vendor insolvency.

- Customer Assurance: Provides peace of mind to businesses relying on third-party software solutions.

- Legal Safeguards: Establishes clear terms for accessing source code under predefined conditions.

Why Australian Companies Should Consider Software Escrow

The recent wave of tech company insolvencies highlights the importance of implementing safeguards like software escrow:

- Dependency on Critical Software: Many businesses rely on proprietary software developed by vendors for day-to-day operations. If a vendor becomes insolvent, access to updates, maintenance, or technical support may be lost.

- Protection Against Intellectual Property Loss: Insolvent vendors may liquidate their intellectual property assets, leaving customers vulnerable to disruptions or legal disputes.

- Ensuring Operational Resilience: By securing access to source code through escrow agreements, businesses can continue using critical software without interruption.

How Software Escrow Works

Software escrow arrangements typically involve three parties:

- Software Vendor /Depositor: The software provider who deposits source code and other assets into escrow.

- Customer / Beneficiary: The business relying on the software.

- Escrow London / The Escrow Company: An independent third party responsible for managing the escrow account.

Key Features

- Automated deposits with regular updates to ensure the escrowed materials remain current.

- Verification services to confirm that deposited materials are complete and functional.

- Release conditions that specify when customers can access escrowed assets (e.g., vendor insolvency or breach of contract).

Conclusion

The rise in corporate insolvencies across Australia—including notable cases within the technology sector—underscores the importance of safeguarding business continuity through measures like software escrow. For companies dependent on third-party software solutions, vendor insolvency can pose significant risks that disrupt operations and jeopardize growth.

By implementing software escrow agreements with Escrow London, businesses can mitigate these risks effectively while ensuring resilience against unforeseen challenges. As insolvency rates continue to climb, proactive strategies like these will become increasingly essential for maintaining stability in an unpredictable economic landscape.

Escrow London was founded by a team of Australian entrepreneurs in London. Since its inception, the company has grown worldwide with offices in Sydney, London and Atlanta. Australian clients include Westpac, Colonial First State, NSW State Government, TK Maxx, Five Guys, Rabo Bank Australia, Zurich Insurance.

How to Contact Escrow London Australia

Visit Escrow London Australia website – www.escrowlondon.com

Call us! +61-2-7229-4872

Google: Software Escrow Australia or Escrow London Australia

To understand more about Software Escrow and how Escrow London can help click here.

To keep up to date with Escrow London follow us on LinkedIn.