Have you considered your SaaS vendor’s financial stability?

As companies adopt SaaS applications to further enhance their businesses, they hand over significant control of their critical applications without any vision of the financial stability of the SaaS vendor.

On the surface, it would appear that the critical SaaS application is functioning as expected, but behind closed doors the SaaS vendor may be struggling to meet standard payments to their hosting suppliers such as AWS, Microsoft Azure or Google Cloud.

Imagine a situation where your business is relying on a critical piece of software to manage customer orders that is SaaS based and hosted within AWS. Without warning, you receive a 404 page not found error. You try to call your SaaS vendor but your calls go unanswered. There is no response to your emails and the pressure is mounting as you can’t take customer orders. By lunchtime, you receive information that your SaaS vendor has entered into administration.

What could have you done to reduce the risk of this happening to your business?

In order to mitigate against this risk and to receive early alerts of potential financial issues, companies are engaging with Escrow London to implement a Vendor Financial Monitoring service that provides a pre-emptive alert if there appears to be any payment irregularities with their SaaS vendor.

How this works

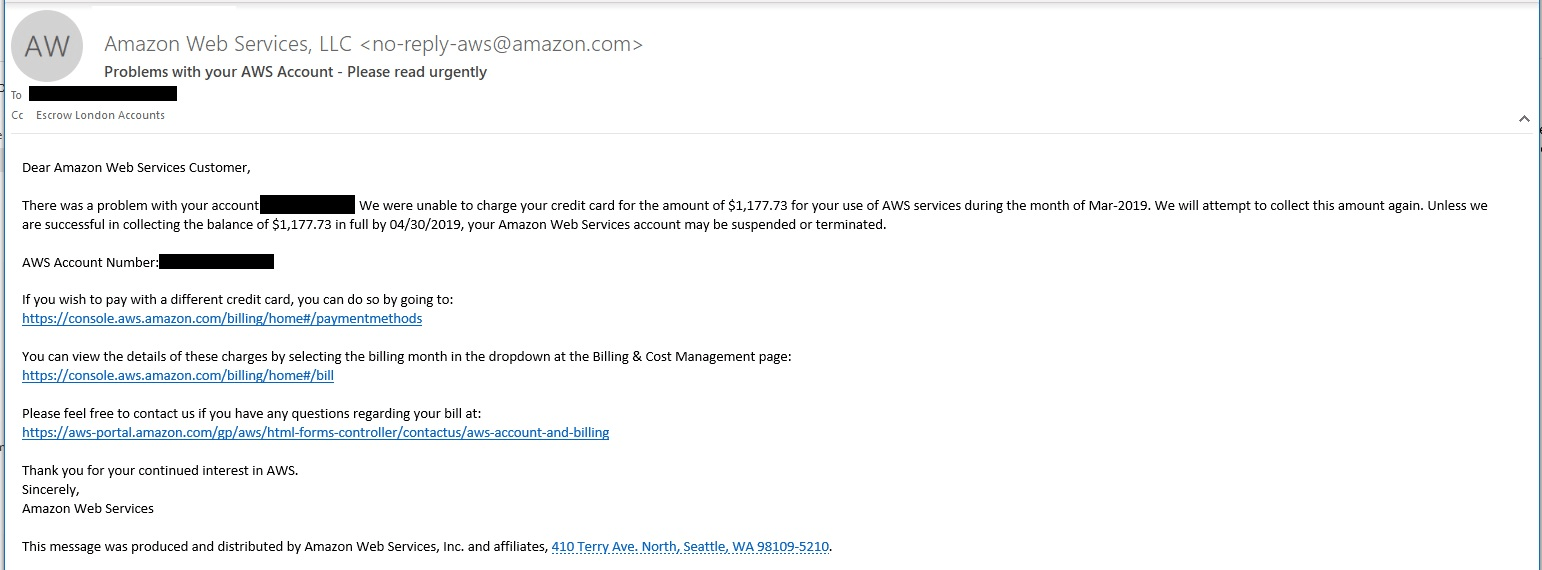

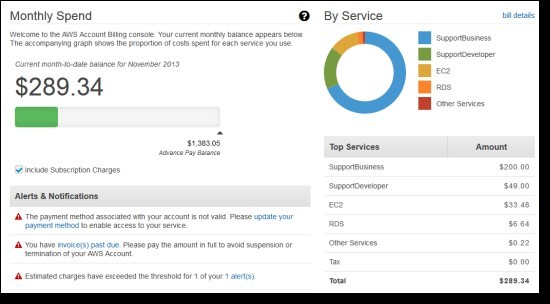

On a regular basis, your SaaS vendor will be paying subscription and hosting fees for critical third-party services. Under the Vendor Financial Monitoring service, Escrow London will monitor those payments both automatically and manually to ensure that all payments are made on time to the registered hosting suppliers. If an invoice goes unpaid, Escrow London will notify all parties which will allow time for the SaaS vendor to rectify the issue and provides an early alert to the beneficiary of possible financial difficulty within the SaaS vendor.

Example of AWS termination of service email received under our Vendor Financial Monitoring service.

Should a Financial Event of Default be invoked by the beneficiary as specified in the SaaS Escrow Agreement, Escrow London will have the authorisation and rights to pay the vendor invoice(s) on behalf of the beneficiary. This process will ensure a short term ‘lights on’ solution until business continuity or disaster recovery decisions are made.

Follow the links to learn more about our unique Vendor Financial Monitoring services and other SaaS escrow continuity solutions.